The future of finance and the role of Banking -as-a-Service providers

- Atinuke Adeniran

- Sep 26, 2024

- 6 min read

Updated: Oct 2, 2024

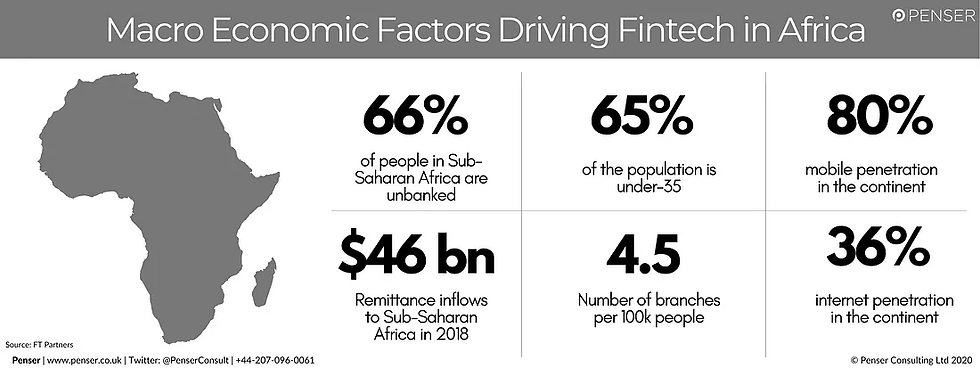

In many sectors, the African economy is playing catch up to other more developed economies. Fintech is not one of those sectors. Africa has been and continues to be a market leader and pace setter in fintech. African economies, particularly East African economies have pioneered the use of mobile money and Africa still makes up 70 percent of the $1 trillion mobile money market.

The potential of fintech in Africa is massive, driven by a large demand for financial services and the surge in mobile phone penetration (fun fact: there are more mobile phone users in Africa than in the USA). With over 350 million adults lacking access to formal financial services, fintech companies are setting up to address these gaps and tap into the massive opportunity. Non-financial companies are also entering the fintech space and providing embedded finance and banking services to their clients ranging from Buy-Now-Pay-Later (BNPL), e-wallets, payments, etc.

One of the most promising trends is the rise of Banking-as-a-service (BaaS) providers who are at the heart of the fintech expansion. BaaS companies provide financial services and infrastructure as APIs to third party fintech and non-fintech companies. These APIs allow these third parties to offer a wide range of services without having to build the financial infrastructure from scratch. Some examples of these APIs are:

Open banking APIs that aggregate customer data and financial information across various platforms, therefore allowing organizations to perform KYC checks, or use the data for credit scoring.

Credit scoring APIs that perform credit checks on potential borrowers and produce credit scores.

APIs that enable companies to create electronic wallets and/or issue virtual or physical cards.

APIs that enable instant transfers and bill payments

APIs that provide access to savings and investment platforms and products

Core banking solutions that enable companies to automate their lending and manage and track their loan portfolio.

For licenced traditional banks and non-licensed companies and fintech companies looking to offer banking products, the benefits of a robust BAAS industry are clear. For fintech companies and companies looking to launch embedded finance products, the ability to plug and play these APIs massively reduces their Go-To-Market time and cost considerably. As these organisations access banking capabilities traditionally only offered by a licensed bank, they can provide banking services within their platform, prioritising a better overall experience for their customers without needing to build and maintain their own banking infrastructure or licence. Traditional licensed banks also benefit from a wider customer base by effectively white labelling their products to non-licensed companies, or by using these APIs to digitize their existing offerings.

The Banking as a service market in Africa is heating up. Companies like Qore digitize and automate the operations of financial institutions, and provide modules that enable end-to-end lending automation, instant card issuance, direct debit collections etc, thereby displacing existing foreign core banking solutions used by local financial institutions but tailored for Western markets. Companies like Mono, Pngme, and Okra provide open banking infrastructure that allow customers to access financial data from institutions across Africa through a single API. These companies provide access to critical customer data including mobile phone data and financial data which can be used to conduct KYC checks, perform credit worthiness checks, etc. Other companies including Indicina and OZE provide loan automation and management tools as well as credit algorithms to help companies in making credit decisions and in deciding credit worthiness. New entrants like Bridgecard provide instant card issuance. Other entrants including Anchor and Stitch provide a broader suite of banking products.

As the market evolves, here are some of the top trends we expect to see:

1. BaaS providers will shift from offering targeted products to providing full suite offerings. As competition ramps up, BaaS providers will need to constantly spend on developing new products and offerings to remain competitive. The future market leaders will offer multiline embedded fintech products, allowing them to act as one stop shops for launching bank accounts, wallets, credit and debit cards, payments and more. The constant need to develop new product offerings and services as opposed to generating multiple revenue streams via one product or service can be a limiting factor to the growth of providers as significant amounts of capital are spent on building solutions. An exception might be with open banking providers who aggregate financial data and customer data from various sources, which provides stronger barriers to entry that might enable them to remain specialized.

2. There will be a race to the bottom in pricing and margins will become lower with time. Revenue models utilised by BaaS providers are weak and price margins are low. As new entrants get into the market, the price pressures will deepen. Winners in the market will be companies that are able to achieve scale quickly to capitalize on economies of scale.

3. Winners in the market will need to offer deeper services as their moat. Customers will likely use a variety of APIs and companies in building their products. Customer loyalty is weak as switching costs are low and these customers can also decide to build their own solutions. Winners in the market will be those that have differentiated and deepened services. For example, payment platforms and virtual cards issuers can deepen their offering by facilitating foreign currency spending, digital loan management API providers or credit scoring tools can strengthen their offering by also providing capital/balance sheet for the loans, etc.

4. A core differentiator that is the likely to emerge is the strength of banking networks and partnerships. BaaS providers who partner with poor banking partners will mirror these poor services in their offering, and this will lead to a loss of customers over time. Conversely, BAAS Providers with strong and reliable banking partners will win. In addition, the ability to lock in multiple partnerships can lead to a differentiated and stronger offering. In the US, companies like Treasury Prime have allowed clients to move between banks, thus allowing fintech companies and enterprises to choose the best banking partner for a particular product or service and move money between banking partners instantly.

5. The ability to offer superior customer service is a strong factor in determining the companies that will dominate. Firstly, purely text and email driven customer service offerings are unlikely to scale in the low trust markets in Africa. Companies need to offer superior and speedy customer service offerings which include phone calls.

6. Self service providers that allow customers seamless integration of API’s will become preferred solutions for customers. As the banking as a service market grows, self-service platforms that allow users to onboard themselves and integrate necessary APIs without the requirement for platform providers to supervise the integration processes will become more popular.

7. Over time, there will be consolidation in the market, driven by M&A activity. M&A activity in this space is already prominent in markets such as the US. Earlier this year, Marqeta acquired financial infrastructure startup Power Finance. Similarly in Africa, we expect a trend of acquisitions by major players in the space looking to expand their product offerings or markets.

8. Companies that do not prioritize cybersecurity and data protection will ultimately lose out and lose customer trust. Tackling potential cyber-security breaches may well be the most important task ahead of any BaaS provider. Companies in Africa, including Union 54 and Payday have suffered security breaches that can lead to disastrous outcomes for the companies and a lack of trust in their products. As banking as service providers store multiple customer data, there is greater risk of data breaches if hackers can access their systems. In March 2023, the Central Bank of Nigeria shared its most defined regulatory document providing operational guidelines for Open Banking, making Nigeria the first country in Africa to adopt clearly stipulated Open Banking regulations. There is a need for other countries to follow suit. There is an even greater need for companies to apply these guidelines in their operations.

As investors, we remain excited about the potential of BaaS providers, given that they are the building blocks of the fintech revolution. Indeed, we are optimistic that one day, because of these BAAS companies, any company can indeed become a fintech company.setter in fintech. African economies, particularly East African economies have pioneered the use of mobile money and Africa still makes up 70 percent of the $1 trillion mobile money market.

This was an insightful and forward-thinking piece on how Banking-as-a-Service is reshaping the financial landscape. I loved how you explained BaaS’s role in accelerating fintech innovation and expanding access to financial services. The trends and real-world context made the future of finance feel exciting and tangible—great work! Sidney De Queiroz Pedrosa

Insightful and timely article! Loved how you broke down the evolving finance landscape and clearly explained the crucial role of Banking-as-a-Service providers. This piece offers real clarity on future trends and opportunities — valuable read for anyone passionate about fintech and innovation in banking! Veronica Dantas

Insightful and forward-thinking post! Loved how you unpack the role of Banking-as-a-Service in driving fintech growth and financial inclusion. The trends and real-world context make the future of finance easier to understand and truly inspiring. Great read! Daniel Dantas

This post is a powerful testament to Africa’s leadership in fintech—your spotlight on mobile money innovation is both inspiring and timely. As the continent continues to shape the future of finance, modern debit card solutions are evolving to match that momentum. With virtual cards and flexible transactions, platforms like FuncCards offer real-time control, enhanced security, and seamless integration with mobile-first ecosystems. Whether you're building in Nairobi or Lagos, customizable virtual debit cards are helping entrepreneurs and consumers alike unlock new levels of financial freedom.